Companies are moving to add more automation to their internal controls over financial reporting and plan to increase their investment in automation of ICFR in the next 6-to-18 months, according to a new study.

The survey, conducted by the Financial Executives Research Foundation (FERF), found that more than 80 percent of respondents at big companies (more than 10,000 employees) plan to increase investment in automating financial reporting controls in the coming months.

The survey of nearly 200 senior-level financial executives finds that a quarter of respondents from large companies say they plan to increase investments in automating such internal controls in the next year, while another 56 percent say they would spend more on automation over the next year and a half. Just 19 percent of large-company respondents say they had no plans to increase investment in automation of ICFR during that timeframe.

“Financial executives are trying to make sure not only that they’re competent in their reporting, but that they are really confident in the process that underlies all of that reporting. That’s the biggest concern,” says James Rice, vice president at Greenlight Technologies, which participated in the survey. Rice says the technology to automate financial controls has advanced in recent years.

One of the things that companies are doing, says Rice, is making the transition from considering potential risks to detecting actual violations in real time. “It’s not about something that could go wrong, or a bad thing that could happen; it’s about, ‘here are the actual instances where material violations, material weaknesses, and material deficiencies across my control process have actually happened.’ And by looking at that information I can now see something that’s more business relevant and has a business impact,” says Rice.

Small Company Disconnect

While large companies are clearly looking to automate more of the ICFR process, far fewer respondents to the survey from small companies have plans to make new investments in automating financial reporting controls. A full 60 percent say they have no plans to make such investments, while just 11 percent plan to increase investment in ICFR in the next year, and 29 percent plan to in the next 18 months.

Not surprisingly, small companies have much less mature systems of ICFR and tend to have less automation of financial controls. Indeed, just 17 percent of small company respondents say their ICFR systems are either “capable” or “mature,” the top levels on the Capability Maturity Model. In comparison, 52 percent of large company respondents say their financial control processes are at the top two maturity levels. Still, large companies have plenty of room to improve the maturity of their financial control processes as well, since 22 percent say they are still in the bottom two levels on the maturity scale.

Not surprisingly, small companies have much less mature systems of ICFR and tend to have less automation of financial controls. Indeed, just 17 percent of small company respondents say their ICFR systems are either “capable” or “mature,” the top levels on the Capability Maturity Model. In comparison, 52 percent of large company respondents say their financial control processes are at the top two maturity levels. Still, large companies have plenty of room to improve the maturity of their financial control processes as well, since 22 percent say they are still in the bottom two levels on the maturity scale.

“The most mature organizations are using technology to automate, not only the compliance and governance part of ICFR, but the review and assessment part of it too,” says Mark Kissman, CFO of Greenlight. “Automation frees up resources,” he added.

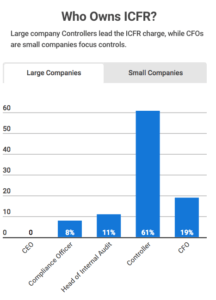

Who Owns ICFR?

FERF also asked who leads the effort on internal controls over financial reporting. At large companies, ICFR is led by the controller in 61 percent of the cases, according to respondents, and by the CFO at 19 percent of companies. Line-of-defense functions also lead ICFR processes—although less often—with 11 percent of respondents saying internal audit heads the effort, and 8 percent saying that compliance does.

At smaller companies, line-of-defense functions are less likely to head the ICFR effort, with internal audit taking responsibility for financial reporting controls 6 percent of the time, and compliance 3 percent of the time. At a majority of small companies (62 percent), the CFO is in charge of ICFR.

As companies continue to push for automation of controls they will continue to see benefits, such as taking human error and manipulation out of the equation, cutting costs, and freeing up employees to do more high-value work. Internal controls over financial reporting remains a fruitful place to adopt greater automation and realize those benefits. ![]()

Todas as corporações e conglomerados, deveriam adotar a automação do ICFR, para melhorar sua gestão de segurança e confiabilidade nos números produzidos em suas operações e diminuir as FRAUDES fiscais.