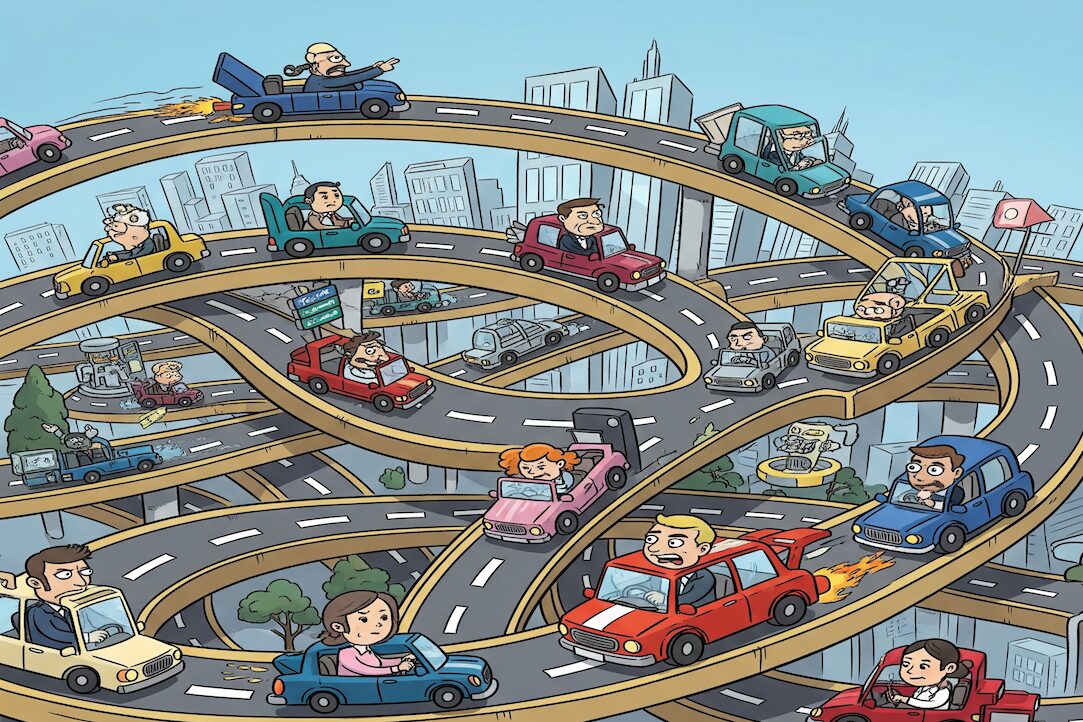

Imagine driving on a constantly changing highway: the speed limits and lane directions are shifting and updating, the exit ramps and destinations rerouting, all while you are mid-journey. How do you, the driver, stay on course? You rely on an up-to-the-minute navigation system. You watch for new road signs. And you drive defensively to avoid collisions.

Today’s regulatory landscape shifts frequently, seemingly on an almost daily basis. This dynamic environment is characterized by unprecedented velocity and complexity as new legislation emerges, enforcement priorities pivot like sudden detours, and technological advancements create novel risks of unexpected road hazards.

Compliance leaders are the vigilant drivers on this ever-changing highway, actively seeking counsel, staying abreast of new regulations, and engaging in preemptive risk management. This demanding, unpredictable terrain requires more than a periodic compliance tune-up; compliance programs must receive constant attention to operate at peak performance in this dynamic environment.

Mapping the Original Routes: The Advent of U.S. Regulation

Business regulation in the United States has been around since nearly the dawn of the country, of course, but its scope, focus, and intensity have evolved significantly since then.

The first major regulatory agency, the Interstate Commerce Commission (ICC), dates back to 1887 amid the rise of large industries and concerns about monopolies and safety. Economic regulation was the focus then, and the ICC was created primarily to regulate the railroad industry. President Franklin D. Roosevelt vastly expanded the federal regulatory apparatus in the wake of the Great Depression. New agencies were created to oversee banking (FDIC), securities (SEC), labor relations (NLRB), and communications (FCC), effectively paving new regulatory roads. The rapid growth of federal agencies during the New Deal led to the Administrative Procedure Act of 1946, which was enacted to bring order, uniformity, fairness, and accountability to the burgeoning federal administrative state, establishing standardized road rules for regulators.

The Wave of Social and Safety Regulations. The 1960s and 1970s gave rise to a new wave of agencies, like the Environmental Protection Agency (EPA), the Occupational Safety and Health Administration (OSHA), and the Consumer Product Safety Commission (CPSC), which focused on broader societal goals. These agencies often set standards for business operations, moving beyond purely economic controls and adding new types of safety lanes and environmental considerations to the compliance map.

Navigating Regulatory Cycles: From Cruise Control to Heavy Traffic. The regulatory environment has oscillated since the 1980s. Major financial crises and corporate scandals tend to trigger periods of heavier regulation—imagine sudden traffic jams and new toll booths—often followed by periods of deregulation and burden reduction driven by inefficiency concerns. This cyclical pattern has become more pronounced and faster in recent decades.

Today’s High-Speed, Multi-Lane Mayhem

Today’s regulatory landscape is unique and characterized by unprecedented complexity, stemming from interconnected factors.

The Global Expressway and Tech-Driven Detours. Regulation was once primarily national and driven by industrialization and economic crises. Now it is intensely global, interconnected, and touches on broader societal issues. Rapid technological advancements, particularly in artificial intelligence, data analytics, and digital finance, create novel risks and ethical considerations that necessitate new rules of the road for privacy, cybersecurity, and market conduct. Regulators struggle to keep pace, leading to reactive rulemaking, which results in poorly marked lanes, sudden regulatory potholes, or regulations that quickly become outdated before the asphalt even dries.

Geopolitical Junctions and ESG Overpasses. Geopolitical events like conflicts, trade disputes, or shifting alliances trigger immediate regulatory responses, particularly concerning sanctions, tariffs, and export controls, forcing abrupt rerouting. Mounting societal and investor pressure, especially concerning Environmental, Social, and Governance (ESG) criteria, drives demand for greater corporate transparency and accountability. This adds new lanes and destinations to the compliance map beyond traditional financial and operational rules.

Exiting to Variable-Speed State Routes. Increasingly, states are implementing their own regulations in areas like data privacy and environmental standards. This creates a complex patchwork of requirements, like navigating a series of local roads with differing speed limits after exiting the federal highway. These regulations can vary significantly across state lines, complicating compliance for companies operating nationwide and requiring drivers to adjust their speed and awareness.

The Whiplash Effect. Heightened political volatility is responsible for the pace and volume of change. Major regulatory shifts historically occurred over decades. Today, significant changes can happen rapidly, driven by executive actions, geopolitical events, or swift legislative responses. Political changes bring new enforcement priorities and legislative agendas. Rules implemented by one administration may be quickly frozen, reviewed, or repealed by the next. This “regulatory whiplash” created by frequent and intense policy reversals creates a far more uncertain operating environment that forces companies to constantly slam on the brakes or accelerate unexpectedly, making smooth navigation nearly impossible.

The Breakdown Lane: Why Periodic Inspections Aren’t Enough

How can companies avoid breakdowns while driving through this demanding, unpredictable terrain? They must adopt a continuous evaluation mindset rather than conducting backward-looking, periodic assessments of compliance programs.

A reactive approach to compliance is insufficient. Periodic reviews often focus on identifying past failures or existing gaps. They are not designed to proactively identify and mitigate emerging threats before they materialize into significant compliance issues.

Furthermore, concentrating evaluation efforts into discrete periods can create significant resource demands, potentially pulling focus from day-to-day compliance operations. And while accurate for a specific point in time, the findings can quickly become outdated. By the time a periodic review is completed, the risks it assessed may have evolved, or new, more pressing risks may have emerged. This can lead to a false sense of security for businesses. A “clean” report from a periodic review might mask underlying vulnerabilities that have developed since the review period or were outside its specific scope. Business leaders must therefore proactively identify and mitigate emerging threats before they materialize into significant compliance issues.

Think of your vehicle’s engine again. An annual inspection might confirm it met standards last year, but it won’t detect a slow leak that started last month or predict a component failure likely to occur next week due to recent heavy usage on rough roads.

The High-Performance Engine: Embracing Continuous Compliance Monitoring

Continuous evaluation moves beyond the static snapshot. It involves embedding monitoring, feedback, and adaptation into the compliance program’s daily fabric. This approach treats the compliance program not as a fixed structure to be occasionally inspected but as a living system that must constantly adapt to its environment, much like a modern vehicle with adaptive cruise control and lane-keep assist.

Adopting a continuous evaluation mindset yields significant advantages:

- Early Hazard Detection: Compliance professionals can identify potential issues and emerging risks much sooner, allowing for timely intervention and mitigation before they escalate into major accidents.

- Enhanced Agility: It enhances adaptability and enables the compliance program to flex and adjust rapidly to regulatory or business environment changes, like smoothly changing lanes in shifting traffic.

- Optimized Resource Allocation: It allows for a more consistent and targeted allocation of compliance resources towards the most pressing current risks, rather than cyclical surges of reactive maintenance.

- Demonstrable Diligence: It provides ongoing evidence to regulators, auditors, and government investigators that the compliance program is actively managed, responsive, and effective in mitigating risk, like having a clean driving record and well-maintained vehicle logs.

- Fostering a Proactive Culture: It promotes a culture where compliance awareness and feedback are ongoing processes, not just annual events, making every employee a co-pilot in vigilance.

Upgrading Your Compliance Vehicle: Implementing Continuous Evaluation

Implementing a continuous evaluation framework requires a shift in mindset and potentially investment in technology and skills. It necessitates moving away from purely reactive, audit-driven checks towards proactive, data-informed monitoring. Key steps include:

- Leadership Buy-in: Secure commitment from senior management, emphasizing the strategic value of proactive compliance risk management as an essential vehicle safety feature, not just a cost.

- Technology Enablement: Identify and leverage appropriate tools for data aggregation, analytics, monitoring, and regulatory intelligence gathering. This means investing in an advanced “cockpit” with real-time “dashboard telemetry” (data analytics platforms) and a constantly updating “GPS” (AI-powered horizon scanners and regulatory update services) to see around the next bend and anticipate merging traffic or road closures.

- Data Integration: Break down silos to ensure relevant data from across the organization feeds into the compliance monitoring process, like ensuring all vehicle sensors report to the central computer.

- Skill Development: Train and equip compliance teams with the skills needed for data analysis, trend spotting, and interpreting diverse feedback sources, turning them into expert navigators.

- Phased Implementation: Start by focusing on high-risk areas and gradually expand the continuous monitoring approach across the program, like mastering local routes before embarking on a cross-country journey.

Driving Towards a Resilient Future: The Road Ahead

The pace of regulatory change shows no signs of slowing down or becoming less complex. For compliance programs to remain effective guardians of organizational integrity and value, they must evolve beyond periodic check-ups. Like maintaining a high-performance engine for a demanding journey, continuous monitoring, regular feedback, and agile adjustments are essential. By embracing a continuous evaluation model, compliance professionals can move from simply reacting to the past to proactively navigating the complexities of the present and preparing for the uncertainties of the future, ensuring their programs are not just compliant on paper but resilient in practice, ready for any road, any condition. ![]()

Kristin B. Johnson (kristin.johnson@woodsrogers.com) is an attorney in the Government & Special Investigations Practice at the Virginia law firm Woods Rogers.