Cryptocurrency is rising in popularity, and national banks were uncertain about how to handle them.

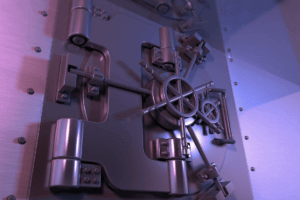

The Office of the Comptroller of Currency answered that question, saying that national banks and federal savings associations can provide cryptocurrency custody services for their clients, the banking regulator said in a letter on July 22.

The letter, sent to an unidentified party, clarified the role that national banks can take toward cryptocurrency. Compliance guidelines were ambiguous for banks that wanted to provide these services.

The OCC’s letter affirmed that holding cryptocurrency is the modern form of traditional bank holding services, and that bank services could even expend beyond just passively holding unique cryptographic keys. Banks may provide the services as long as they manage compliance risks and comply with regulations, such as anti-money-laundering laws, that can especially be abused with cryptocurrency.

The OCC held that banks need adequate systems in place to “identify, measure, monitor, and control the risks of its custody services,” and that the systems should include “policies, procedures, internal controls, and management information systems governing custody services.” Internal controls should include the safeguarding of assets and producing reliable financial reports along with compliance.

As with other custodial activities, the banks are expected to have dual controls with proper segregation. Special audit procedures especially tailored to the digital nature of cryptocurrency assets may also be necessary. ![]()

Stephanie Liu is assistant editor of Internal Audit 360°