In the wake of a global pandemic, organizations are working to assess potential risks with a renewed urgency, given the disruption and severity that COVID-19 inflicted on businesses and society in general over the past few years.

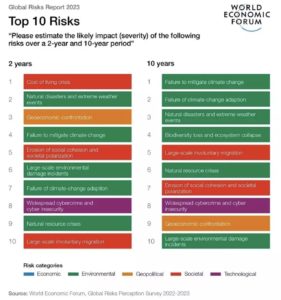

One of those organizations, the World Economic Forum, released its Global Risks Report 2023, where it says conflict and geo-economic tensions have triggered a series of deeply interconnected global risks. These include energy and food supply crunches, which are likely to persist for the next two years, and strong increases in the cost of living and debt servicing. At the same time, these crises risk undermining efforts to tackle longer-term risks, says the WEF, notably those related to climate change, biodiversity, and investment in human capital.

Once again, environmental risks dominate the concerns flagged by the WEF by impact and likelihood, looking ahead towards the next decade. Societal fractures, uncertainty, and anxiety will make it more difficult to achieve the coordination needed to address the planet’s continued degradation, says the WEF. The organization argues that the window for action on the most serious long-term threats is closing rapidly and concerted, collective action is needed before risks reach a tipping point.

The report, produced in partnership with Marsh McLennan and Zurich Insurance Group, draws on the views of over 1,200 global risk experts, policy-makers, and industry leaders. Across three timeframes, it paints a picture of the global risks landscape that is both new and eerily familiar, as the world faces many pre-existing risks that previously appeared to be receding.

At present, the global pandemic and war in Europe have brought energy, inflation, food, and security crises back to the fore. These create follow-on risks that will dominate the next two years, says the WEF, such as the risk of recession; growing debt distress; a continued cost of living crisis; polarized societies enabled by disinformation and misinformation; a hiatus on rapid climate action; and zero-sum geo-economic warfare.

At present, the global pandemic and war in Europe have brought energy, inflation, food, and security crises back to the fore. These create follow-on risks that will dominate the next two years, says the WEF, such as the risk of recession; growing debt distress; a continued cost of living crisis; polarized societies enabled by disinformation and misinformation; a hiatus on rapid climate action; and zero-sum geo-economic warfare.

“The short-term risk landscape is dominated by energy, food, debt, and disasters. Those that are already the most vulnerable are suffering—and in the face of multiple crises, those who qualify as vulnerable are rapidly expanding, in rich and poor countries alike. In this already toxic mix of known and rising global risks, a new shock event, from a new military conflict to a new virus, could become unmanageable. Climate and human development therefore must be at the core of concerns of global leaders to boost resilience against future shocks,” said Saadia Zahidi, managing director of the World Economic Forum.

High Anxiety

A separate study, conducted by Protiviti, finds that uncertainty in today’s marketplace is presenting both new and ongoing risks for executives and board members. Alongside talent, labor and culture-related risks, the survey, “Executive Perspectives on Top Risks for 2023 and 2032,” also reveals that senior decision-makers remain concerned about broader macro risks such as the softening economy and the state of global supply chains.

Continuing a trend reported in last year’s survey, three of the top four risks highlighted by survey respondents for 2023 are related to talent. Of the 38 risks included in the survey, the top five risks identified by business leaders for the coming year are:

- Organizational succession challenges and ability to attract and retain top talent

- Economic conditions (including inflationary pressures)

- Increased labor costs

- Resistance to change in company culture

- Uncertainty surrounding organizational core supply chains

Looking ahead to 2032, talent attraction and succession planning remain a primary concern, especially the need for tomorrow’s talent to become fluent in a series of fast-moving emerging technologies such as quantum computing, advanced AI and the metaverse.

Get It Together

The WEF report sounds a major alarm that more needs to be done to head off global challenges that we all face. “Unless the world starts to cooperate more effectively on climate mitigation and climate adaptation, over the next 10 years this will lead to continued global warming and ecological breakdown,” the WEF report’s authors write. Failure to mitigate and adapt to climate change, natural disasters, biodiversity loss and environmental degradation represent five of the top 10 risks—with biodiversity loss seen as one of the most rapidly deteriorating global risks over the next decade.

In parallel, crises-driven leadership and geopolitical rivalries risk creating societal distress at an unprecedented level, as investments in health, education and economic development disappear, further eroding social cohesion. Finally, rising rivalries risk not only growing geo-economic weaponization but also remilitarization, especially through new technologies and rogue actors.

Looking Out to the Future

The Protiviti survey respondents also rated the expected impact of the 38 risks in 2032, assessing how the risk landscape might shift over the coming decade. The top five risks identified for 2032 are:

- Organizational succession challenges and ability to attract and retain top talent

- Adoption of digital technologies requiring reskilling and upskilling employees

- Speed of disruptive innovations enabled by advanced technologies

- Resistance to change in company culture

- Ensuring data privacy and compliance with growing identity protection expectations and regulations

“In the current tight labor market, talent retention has naturally become a top risk that executives are worried about, however, with the added complication of a softening economy, they need to tread carefully,” said Pat Scott, EVP, Global Industry and Client Programs, Protiviti. It’s important that executives are weighing today’s economic pressures against the possible costs a decade from now and are making prudent organizational choices that increase their company’s resilience next year while laying the foundation for success in the years to come.”

Mark Beasley, professor and director of the Enterprise Risk Management Initiative, Poole College of Management, NC State University and co-author of the report, said: “It’s clear that uncertainty abounds across the economy, which has triggered heightened risk concerns for executives and boards. The overall severity and magnitude of risks are at the highest level we’ve observed over the last 11 years this study has been conducted.” ![]()

Joseph McCafferty is Editor & Publisher of Internal Audit 360°