If the COVID-19 pandemic has highlighted anything in corporate America, it is that the need for good governance structures is vital to effectively navigating these trying times.

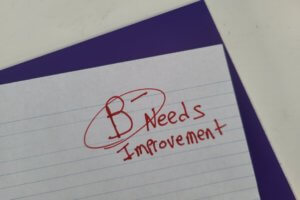

So how good are governance practices at major American companies? Not terrible, but not great either, says a new report from the Institute of Internal Auditors and the University of Tennessee’s Neel Corporate Governance Center. The joint report, American Corporate Governance Index finds companies scored an average of a B- in 2020, slightly improved from its 2019 grade of a C+.

“The score still falls short of what The IIA and UT’s Neal Corporate Governance Center consider ideal practices for ensuring corporate sustainability, a healthy culture, transparent and accurate disclosures, and effective policies and structures,” the IIA said in a statement.

Results of the study do show gains across the Index’s eight Guiding Principles of Corporate Governance. Compared with last year’s results, company size (revenue) and industry took on bigger roles in explaining variations in index scores. The results suggest that, during periods of heightened risk such as COVID-19, companies in regulated industries (financial services, and transportation and utilities) have stronger governance.

Fewer Failing Grades

The most notable improvement, according to the Index, is a decrease in the number of companies receiving a failing governance grade. In 2019, 10 percent of companies scored an F, compared with only 2 percent in 2020. Similar to the first year of the study, the majority of companies scored in the B and C range of governance performance, with less than one-fifth earning an A-range performance.

“While no one wants to see a repeat of 2020, the pandemic-fueled focus on crisis management likely contributed to the modest gains we see in this year’s ACGI,” said IIA President and CEO Richard Chambers. “However, the Index tells us that boards still don’t challenge management as much as they should. This year’s ACGI shows that more than one-third of board members would be hesitant to offer a contrary opinion or to push back against the CEO. What’s more, boards do not do an adequate job of verifying – or even asking – whether information they receive is accurate or complete, scoring only a D+. This is an essential, baseline element of effective governance.”

Among other key findings of the report:

- Bureaucracy Hampers Governance: Management structures are not always effective at getting the right information to the right decision-makers in a timely manner (Score: C+, or 79).

- Governance Demands Transparency, But It’s Not Always There: Companies could be more purposeful and transparent in choosing and describing their key policies and procedures related to corporate governance to allow key stakeholders an opportunity to evaluate whether those policies and procedures are optimal and reliable (Score: C, or 75).

- Long-term Outlooks and Governance Evaluations Continue to Lag. Companies continue to be deficient in their long-term outlook (Score: C-, or 70). They don’t formally evaluate the full system of corporate governance on a regular basis, leaving the door open the critical gaps (Score: C-, or 71). At the same time, employee receive inadequate training to complete expected job duties (Score: C, or 76).

“The ACGI goes beyond the publicly observable aspects of corporate governance to provide an internal perspective on the effectiveness of corporate governance throughout the organization,” said Terry Neal, director of corporate governance at the Neel Center. “In a crisis, such as the COVID-19 pandemic, a lack of timely or reliable information and less-than-ideal governance measures can affect not just the profitability of the company, but its employees, customers, vendors and others and, indeed, long-term sustainability.”

The ACGI is designed to provide insight into how companies perform in key areas based on Guiding Principles of Corporate Governance. These Principles are based on a compendium of relevant guidance and principles advanced by experts in the field. This year’s index is based on survey responses from 131 chief audit executives working in companies of various sizes, complexities, and industries. ![]()