A trio of internal audit studies published recently indicate that internal audit departments in the United States have a big technology problem. Internal audit is generally behind the times when it comes to adopting leading-edge technology, the reports find.

The studies shed some needed light—along with some dire warnings—on why internal audit is struggling to keep up in a tech-driven, rapidly changing world, both in its own department and as it assesses the risks of the organization’s use of new technologies like artificial intelligence, virtual reality, advanced analytics, and other digital innovations. “Those who fail to integrate these initiatives risk becoming obsolete as their organizations continue to undergo digital transformation at an increasingly rapid pace,” says Brian Christensen, executive vice president of global internal audit at Protiviti.

Despite the high stakes, internal audit is woefully low tech, the studies indicate. Among them is the 2018 PwC State of Internal Audit study, which finds just 14 percent of internal audit departments are “advanced” in their adoption of technology. “The most surprising finding in our report is how small that top group is,” says Lauren Massey, a principle in the PwC’s U.S. internal audit, compliance, and risk management practice. “I think we were expecting to see that number a little higher, especially when you consider how powerful that category is in all the different things they are doing.”

Equally troubling news about internal audit’s technology difficulties comes from a recent study from Protiviti, which finds that internal audit departments in North America are well behind their counterparts in Europe and Asia when it comes to using advanced data analytics. The study of more than 1,500 global internal audit professionals and executives finds that 76 percent of respondents in both the Asia-Pacific and Europe regions said that new data analytic tools are in use by their internal auditors, compared to 63 percent in North America. Worse still, 79 percent of internal audit departments in Europe and 70 percent in Asia have a dedicated data analytics function, while only 40 percent of North American internal audit shops can make that claim.

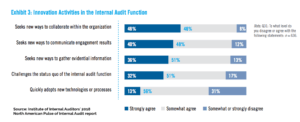

A third study, from the Institute of Internal Auditors, finds that internal audit departments generally aren’t very nimble, nor are they good at processing rapid change. According to the IIA’s 2018 North American Pulse of Internal Audit survey, just 45 percent of chief audit executives consider their internal audit functions to be “very” or “extremely” agile, and just 32 percent say their internal audit functions challenge their own status quos.

“CAEs need to break out of their historical frame of reference and be nimble enough to pivot, to refocus, and to reposition internally in order to create a path towards agile internal auditing,” says IIA President and CEO Richard Chambers.

The IIA study addressed the question of technology adoption directly. It finds that just 13 percent of the CAEs surveyed said they strongly agreed with the statement that their internal audit function “quickly adopts new technology or processes.” Another 56 percent somewhat agree that they quickly adopt new technology, and nearly a third (31 percent) fully admit that they don’t adopt new technology in a timely manner.

From Adversity, an Opportunity

The PwC report heralds a “technology inflection point,” and lists eight “emerging technologies expected to soon have significant global impact.” Those include: internet of things, augmented reality, virtual reality, blockchain, artificial intelligence, 3D printing, and robotics. PwC’s central message is that internal audit functions must adopt these technologies for use themselves if they are to add value in assessing the risks of how they are used throughout the organization. In other words, the rapid pace of change is only accelerating, and internal audit departments that don’t gain at least some understanding of these technologies will only fall further behind, risking irrelevance.

While it may be hard to imagine an internal audit department of auditor robots wearing VR headsets, and printing out 3D risk models that they hand to waiting drones to deliver to the CEO’s office, most internal auditors will agree that they could do a better job of getting with the technologic times. Certainly, the usefulness of AI, machine learning, and blockchain is apparent and already being used in forward-thinking internal audit shops globally.

The study divides internal audit departments into three groups: advanced adopters of technology, which it calls “evolvers,” which make up just 14 percent of those studied; “Followers,” which take notice and follow in technology adoption at a slower pace (46 percent); and “observers,” which include the 37 percent of internal audit departments that have only basic or no technology use.

“A significant opportunity is there in that some of the barriers that we’ve seen in the past, whether it was cost or skills that you may need to be actually able to take advantage of some technologies, are no longer there, “ says PwC’s Massey. “There’s a real opportunity for observers to get in the game, make some investments, and leap forward significantly.”

Why is Internal Audit Behind on Tech?

So what’s keeping internal audit from embracing the latest and greatest technologies? The biggest barrier, says Massey, is talent. Internal audit departments are having a devil of a time finding talented candidates, particularly those who have skills and experience in technology areas like advanced analytics or machine learning. This should come as no surprise to internal audit leaders, since they were having a difficult time hiring the right people four or five years ago. Now that the labor market has tightened considerably, with the unemployment rate near 4 percent, the hiring difficulties have only intensified.

This is also apparent in emerging markets particularly Asia amd the Middle East. Even professional firms providing IA and risk services are struggling to incorporate innovative technology which greatly affects value. Additionally, some ACs lack enthusiatic sponsorship to the adoption especially when IA’s performance is perceived to be poor (e.g. when IA is just introduced). This makes IA less exciting plus the fact that incumbents are sticking to the norm.

Technological advancement in IA is sophisticated and challenging as it can’t be done just like picking items off the shelves. Systems, infrastructure and culture are different from one organization to the other. Thus tailor-fitting is a necessity which can at times be costly. And, its relevance is a race with time as technology always evolve. What was adopted today may not be relevant tomorrow.

This makes me sad. IA is struggling as assurance does.

Thanks for your thoughtful and excellent comment. -Joe