The Securities and Exchange Commission awarded a total $50 million to two whistleblowers who assisted the agency in bringing a successful enforcement action. One whistleblower received an award of $37 million and the other received an award of $13 million.

While the SEC did not disclose the identities of the two whistleblowers or any details of the case, the law firm Labaton Sucharow, which represented the unnamed informant who received $13 million, confirmed in a statement that its client was a J.P. Morgan executive who cooperated in the Commission’s investigation of the bank. The award was related to a December 2015 settlement with JPMorgan Chase. The New York-based bank agreed to pay $307 million to settle charges it failed to disclose conflicts of interest to its wealth management customers.

The $37 million award is the SEC’s third-highest award to date after the $50 million award made in March 2018 to joint whistleblowers and more than $39 million award announced in September 2018.

“Whistleblowers like those being awarded today may be the source of ‘smoking gun’ evidence and indispensable assistance that strengthens the agency’s ability to protect investors and the capital markets,” Jane Norberg, chief of the SEC’s Office of the Whistleblower, said in a statement. “These awards show how critically important whistleblowers can be to the agency’s investigation and ability to bring a case to successful and efficient resolution.”

The enforcement action brought as a result of the whistleblowers’ tips charged J.P. Morgan with a preference to invest clients in the firm’s own proprietary investment products without properly disclosing the practice, which compromised two facets of money management—asset allocation and the selection of fund managers—and deprived the bank’s clients of critical information to make fully informed investment decisions.

“Blowing the whistle is rarely easy, and it certainly hasn’t been for my client, but this historic SEC whistleblower award and related enforcement action reaffirms that doing the right thing pays,” said Jordan A. Thomas, an attorney at Labaton who served as counsel to one of the whistleblowers, in a statement. “Thanks to the SEC whistleblower program, today corporate whistleblowers know that the Commission has their back and blowing the whistle anonymously dramatically increases the probability of a happy ending.”

“Blowing the whistle is rarely easy, and it certainly hasn’t been for my client, but this historic SEC whistleblower award and related enforcement action reaffirms that doing the right thing pays,” said Jordan A. Thomas, an attorney at Labaton who served as counsel to one of the whistleblowers, in a statement. “Thanks to the SEC whistleblower program, today corporate whistleblowers know that the Commission has their back and blowing the whistle anonymously dramatically increases the probability of a happy ending.”

Who’s Eligible?

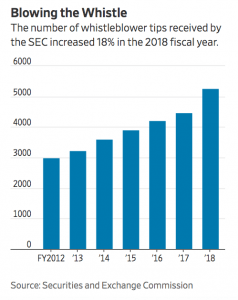

The SEC whistleblower program received a record 5,282 tips during the 2018 fiscal year, an increase of 18 percent from a year earlier, according to a report submitted by the securities regulator to Congress. Whistleblowers may be eligible for an award when they voluntarily provide the SEC with original, timely, and credible information that leads to a successful enforcement action. Whistleblower awards can range from 10 percent to 30 percent of the money collected when the monetary sanctions exceed $1 million. The SEC has now awarded approximately $376 million to 61 individuals since issuing its first award in 2012. All payments are made out of an investor protection fund established by Congress that is financed through monetary sanctions paid to the SEC by securities law violators.

The SEC protects the confidentiality of whistleblowers and does not disclose information that could reveal a whistleblower’s identity as required by the Dodd-Frank Act. ![]()