The Securities and Exchange Commission has sent notice to sports apparel company Under Armour and two of its executives that they could face regulatory enforcement actions for past accounting practices at the company.

The company revealed this week that it received a “Wells Notice” of possible enforcement action from the SEC related to revenue recognition practices between 2015 and 2017. The company maintains that its actions were appropriate and that it is working towards a resolution of the matter with the agency.

The company has been under investigation since 2017 regarding its treatment of revenue between the third quarter of 2015 and the fourth quarter of 2016. The company is suspected of shifting sales figures from quarter to quarter to appear healthier and announced its cooperation in the criminal inquiry in 2019.

Under Amour founder Kevin Plank and CFO David Bergman also received Wells Notices informing them that the SEC is likely to ” allege certain violations of the federal securities laws,” Under Armour said in the most recent regulatory filing.

The Wells Notice “is neither a formal charge of wrongdoing nor a final determination that the recipient has violated any law,” the filing noted, and Under Armour maintains that its “actions were appropriate” will continue to engage with the SEC, including “the opportunity to respond to the SEC Staff’s position.” The company expects “to engage in a dialogue with the SEC Staff to work toward a resolution of this matter,” the filing said.

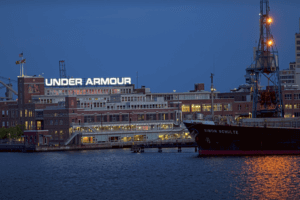

Under Armour has undergone executive turmoil in the last couple years, switching CFOs three times between 2016 and 2017. Plank stepped down as CEO last year but remained as executive chairman. Then-COO Patrik Frisk took over his role. ![]()

Stephanie Liu is assistant editor at Internal Audit 360°